Nigeria: Peaceful election boosts investor confidence in Africa’s largest economy – By Ioannis Mantzikos

A peaceful transfer of power is likely to provide a boost to economic growth in Nigeria, recently impacted by oil price drop, but barely affected by Boko Haram.

A largely peaceful election in which Muhammadu Buhari defeated President Goodluck Jonathan has bolstered investor confidence in Nigeria. Whilst it is widely expected, perhaps unrealistically so, that this military man from Katsina State in northern Nigeria will be more successful in dealing with fighting the Boko Haram insurgency than his predecessor, Goodluck Jonathan, but it is less clear what he might do with the more technical policies that impact on the economy.

Suffice to say there are enormous financial and security challenges for the President elect. Before Buhari’s win, the International Monetary Fund cut its 2015 growth forecast for Nigeria to 4.8 percent, about half the average rate over the past 15 years. Standard & Poor’s downgraded the country on March 20th one level to B+, four levels below investment. The Central Bank’s reserves fell below $30bn in March, equating to roughly five months of import cover.

But there are reasons to be optimistic, since March 31, when Buhari won the election, Nigeria’s benchmark stock index has climbed 15 percent to levels not seen since November last year. This is the Nigerian Stock Exchange All Share Index’s longest streak of gains since September 2012.

Given the weaker oil price and Nigeria’s minimal fiscal savings to date, important challenges will confront the new government. A first crucial challenge is the oil dependent economy. Oil and gas account for more than 90 per cent of export revenues and the government relies on them for 70 percent of fiscal revenues. These have roughly halved in the past six to eight months. In short, the 45 percent fall in the price of Brent Crude since last June has wreaked havoc on Nigeria’s financial health.

While the outgoing government has said tax revenues added $600m to non-oil revenues last year and should double this year, it also admitted that it needs to reduce its reliance on oil to closer to 40 percent.

Nigeria, which pumped almost 2 million barrels a day last month, relies on crude for two-thirds of government revenue and 90 percent of its export income. The drop in prices can to an extent then reduce the cost of refined products it imports. The country also has capacity to increase the supply of oil from its current 1.9m barrels a day to as much as 3.5m-4m b/d if it wanted to go down that route to try to increase revenues.

Another challenge concerns the falling naira, which is stoking inflation. The dollar has gained 17.2 percent against the naira in the past year, making it the third-worst performer in Africa. This is pushing up the price of imports, stoking inflation and hurting businesses across the board.

A third challenge is the economics of the Boko Haram insurgency. While it is true that the group has an enormous political and humanitarian impact on the North-East, this region barely makes up 6.6 per cent of Nigeria’s GDP.

However, multinationals such as Nestlé, Heineken, SABMiller and Unilever, which are pouring in millions of dollars to expand production in the country, will remain cautious until it becomes clear that the threat from Boko Haram has been contained. They are, however, generally able to discern what constitutes a threat to population centres in the north, the most significant being the great northern city of Kano, and those in the richer and more commercially attractive south.

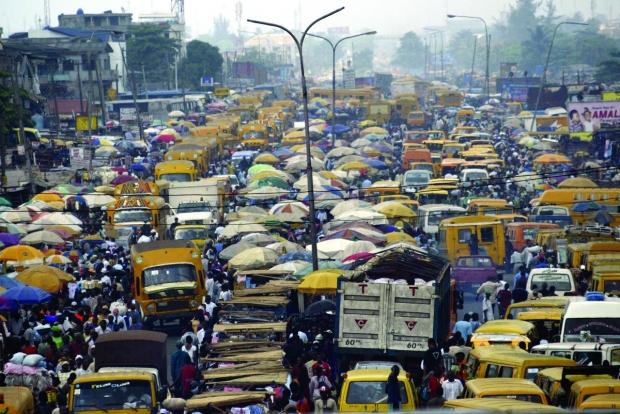

Stock markets have remained relatively stable, and the currency has showed no real volatility. The impact on the economy has remained muted given that violence has not spread to Lagos or the oil-rich Niger Delta. Portfolio investors appear to largely discount the security issues associated with Boko Haram while there has been very little FDI in this part of Nigeria.

In the long term, the fundamentals underpinning Nigeria’s structural growth prospects seem to have changed little. Nigeria remains a strategically important economy for the continent thanks to the size of its market, its attractive demographics and recent reforms made to attract international capital. Moreover, the peaceful handover of power will give Nigeria and Nigerians, a fillip like no other.

Ioannis Mantzikos is a researcher and analyst on Sub-Saharan African Affairs.

Nigeria peaceful transfer of power will surely boost investment in the country. The newly elected President and a former military dictator should be mindful the task before him is enormous . Firstly, the recurrent expenditure should immediately slash.Then fight corruption head -on by seize many property and frozen many politicians bank account and sentencing looters to serving jail term.Also scrab all minister of state positions and deputy positions in other government agencies, which will save the country billions of money.There is needto increase civil servant salary Ensure political offices very unattractive. Drastic cut MP and senator salary by half and ban allowances. Ensure our sea port no longer hijak by customs official causing unneccesary delay of goods to not more than one week goods to clear goods. Electricity supply should seriously given attention. Ajaokuta steel mills should lead the country for the country industrial revolution. The automotive projects should be given more boost that we make Nigeria automotive hub of the continent.Lastly Nigerian military must revamp and to start developing our weapon and jet figthers all the above can be achieved by stop reliance on inport weaponry. Jonathan administration did very well in agriculture and aviation and the momentum must go forward. There should be More emphases on local contents and stop importation of goods locally produced . THEREFORE eCOWAS COUNTRY MUST NOT SIGN ANY BAD AGREEMENT WITH FOREIGN COUNTRY BECAUSE IT WILL HURT NIGERIA INDUSTRIAL REVOLUTION . Nigeria fully ready to work with Buhari administration through their vote was a good indicator.The police department must be overhaul, and ensure NYSC is boost with fund to go into agriculture at the end of their service.There is urgent need for the continuity of Dr Adeshina Akinwunmi agriculture minister in the new adminstration for his job well done in the past years.

The national assembly must show their political will by cutting 2015 annual budget alocation in both house by half.The 150billion naira reduced to 120billion naira should cut down more to 8obillion naira. The proposed subsidy removal should reinstate immediately, while the 2015 approved budget for the federal secretary to the presidency and that of the presidency budget alocation cut to half.Lastly, every imputiny while serving in the public office should immediately reverse so that any state Governor can face embezzlement charges and other corruption related crimes while still serving.. The local government which is the third tier government should allow to function, by alocate monthly alocation to the local government directly and not through the state .By doing this the local government can develop projects themselves .The country witnessing a situation over the years where the state Governor take chunk of local government alocation while local government and community remain very undevelop and remain poorer and if the country truly a democratic state it should not be a problem . Finally, the Buhari administation should scaled back customs official at the nation seaport and airport due to their undue delay clearing in bound containers goods for bribery reason, and those custom officer should immediately reassign to other post and any officer with poor performance track record should be fired immediately.Anational telephone call line should be install to report public officer causing unnecesary delay in obtaining important docuument to doing business such as business license,and other vital documentation.Most country register businesses on line,and Nigeria should not be in isolation . Most nIGERIA FOREIGN EMBASSY AND CONSULAR MAKE IT VERY DIFFICULT TO RENEW NIGERIAN PASSPORT,and visa ,and there is need for solution.To Register business online will cut down corruption ,and will surely improve nigeria image in the global commmunity ways of doing business index figure.