The Africa Business Briefing Feb 2013: Instability in North Africa/It’s the economy, Zuma! – By Desné Masie

Q1 | January 2013 | February 2013

Q1 | January 2013 | February 2013

Desné Masie

This is the first edition of our Africa Business Briefing, which will be published monthly, with business and economics news on the world’s fastest changing continent. A more comprehensive version of our research is available to our corporate members on a quarterly basis. To find out more about corporate membership of the RAS click here.

Download this briefing in pdf. here

TOP STORY

Continued Instability in North Africa and the Sahel

Following the Arab spring and attendant regime change in Tunisia, Egypt and Libya, continued instability in North Africa and the Sahel remains a significant political risk. A French-led military operation was, last month, deployed in Mali to retake the North of the country from a rebel coalition comprising local Tuareg insurgents and Islamist groups,which may become a long-term deployment.

For political analysis on the developments in the region, we refer you to our sister blog “˜Politics Now’ on African Arguments. This briefing will consider the economic implications of the prevailing political environment.

The International Monetary Fund (IMF) forecasts that economic growth for the Middle East and North Africa is expected to decrease from 4.2% to 3.7% in 2013, with political instability being a driver of the slowdown. Moody’s has downgraded Egypt’s sovereign debt citing intensifying civil unrest; the state of emergency; and uncertainty around its ability to secure funds from the IMF. Five Egyptian banks have also been downgraded. Tunisia’s sovereign debt is currently investment grade with a negative outlook. Ratings are not available for Mali and Libya.

However, these developments should not affect broader investor enthusiasm for Africa, which is riding a wave of optimism on the pervasive “˜Africa Rising’ narrative. Fred Baccanello, an analyst for Dominion Asset Management, says: “People who in invest in Africa have been able to differentiate between specific country risks. Before 2008, there was a very large foreign direct investment that took place at the same time as the conflicts in the Democratic Republic of Congo and Cote D’Ivoire. Moreover, people were happy to invest in regions as close to the conflicts as Uganda. Investors are very knowledgeable as to where the specific risks are, and the civil war in Mali should not affect investment in nearby countries such as Nigeria. The same goes for Southern and East Africa.” Investor confidence in Africa therefore continues to be robust, and the strong economic growth and sentiment we have seen in relation to the continent should continue, as investors evaluate the economic environment at a country and case-by-case basis, not at the continental level.

It’s the Economy, Zuma! State of Nation Address South Africa

On February 14th South African President Jacob Zuma delivered his State of the Nation Address to Parliament. The country’s political economy has accordingly been the subject of much politico-economic chat, as exemplified by the author here.

The South African populous appears to be fed up with its ruling party, the African National Congress’ (ANC), tendency to pay nothing but lip-service to economic inequality. South Africa is ranked as an upper-middle income country, with Africa’s largest economy and most sophisticated capital markets, yet it remains one of the world’s most unequal societies by income.

All three credit rating agencies recently downgraded South Africa’s sovereign debt, and the government’s lack of coherence on macro-economic policy has been cited as a major concern not only by the ratings agencies, but also by economic analysts and foreign investors. Analysts have said that the government’s lack of resolve in consolidating the discordant policy macroeconomic framework, under the New Growth Path and National Development Plan, has resulted in little success in tackling poverty and unemployment.

However, Jolyon Ford writes on our Business Africa blog that analysts may have “overcooked their “˜house views’ such that they are now tending to exaggerate the relative downsides of South Africa while overstating the upsides of other African destinations”. Ford asserts that the country still has the most continuous and coherent macroeconomic policies relative to the rest of the continent. The governing alliance (ANC, South African Communist Party and Congress of South African Trade Unions) continues “to ensure a remarkable measure of consensus for such a complex society”. While it may the case that South Africa’s macroeconomic planning is very sophisticated relative to other African economies, the government can do much more to demonstrate it is serious about implementation.

Economic Trends & Forecasts

GDP Growth*

GDP growth for Europe was -0.317 for 2012 and forecasted at 0.895 for 2013, so there is plenty to be optimistic about for investors seeking above average returns (alpha)in Africa. Growth in Sub-Saharan Africa also remains above the Global average, but Conflict in MENA has inhibited economic growth over the past year, and economies are still not growing fast enough to end poverty. The rise of the African middle class has been a significant driver for domestic demand, and oil-producing countries continue to perform well.

Ghana and Nigeria are rising stars, and Kenya should see improved economic performance if its upcoming election goes smoothly. Europe remains Africa’s biggest trading partner and therefore the Financial Crisis in the Eurozone continues to pose threats to Africa’s economic growth through trade links and capital flows. (Seemingly undeterred by the Eurozone sovereign debt crisis, East African states are continuing talks for regional monetary union.)

| Country Group | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| Sub-Saharan Africa | 7.093 | 5.597 | 2.820 | 5.288 | 5.125 | 5.440 | 5.294 |

| MENA | 5.571 | 4.651 | 2.742 | 4.892 | 3.500 | 4.231 | 3.656 |

| Global | 5.400 | 2.761 | -0.611 | 5.265 | 3.851 | 3.533 | 4.073 |

*In constant prices according to IMF data

Markets

FTSE Pan Africa Index

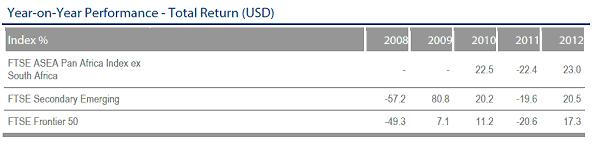

Investment returns in developed markets continue to be sluggish, particularly in the Eurozone. Investors looking for new sources of alpha have contributed to a surge of interest in investments in emerging markets, particularly Africa. To address this need, in December FTSE launched the FTSE ASEA Pan Africa Index Series . The Index represents a basket of shares listed on ASEA (African Securities Exchanges Association) member exchanges. The index series excludes South Africa, and is intended to be a benchmark for African equity and emerging market portfolios, and a foundation for new tradable investment products. The table below shows how the Index performed against the FTSE Secondary Emerging and Frontier 50 Indices.

Source: ASEA

- Capital Markets

Despite the risks emanating from the European sovereign debt crisis investors remain largely bullish about Africa’s economic prospects. Moody’s notes this should result in an increased use of the international capital markets, particularly in debt issuance by sovereigns in the region, who have an infrastructure financing need of about $90bn per annum.

- Equities and Exchanges

With the surge of investor interest in the African equities, we will be following developments on the equities markets closely, particularly on African Stock Exchanges, African companies, and Africa-focused companies operating in other markets.

Growth Boards

The Africa Securities Exchanges Association (ASEA) reports that growth boards (the equivalent of the Alternative Investment Market [AIM] at the London Stock Exchange) are one of the most important boosts for African Business. The Nairobi Securities exchange therefore launched the Growth Enterprise Market Segment (GEMS) on 22 January 2013 on the Nairobi Securities Exchange, and the Zimbabwe Stock Exchange is looking into consolidating an SME bourse. Investors can also access growth markets in Africa through AltX on the Johannesburg Stock Exchange launched in 2003. ASEA says that private equity and venture capital remain central to the growth of many African enterprises on the continent.

- Sovereign ratings

Moody’s issued first-time public ratings for Kenya, Nigeria and Zambia to reflect its “continued commitment to meeting demand for insight on sovereign creditworthiness and their local capital markets across the pan-African region”. In addition to the ratings announced for Kenya, Nigeria and Zambia, Moody’s other sovereign ratings in the sub-Saharan African region comprise Angola, Botswana, Mauritius, Namibia, Senegal and South Africa. The majority of African sovereigns, however, have not been rated by the big three agencies, Moody’s, Fitch Ratings or Standard & Poor’s.

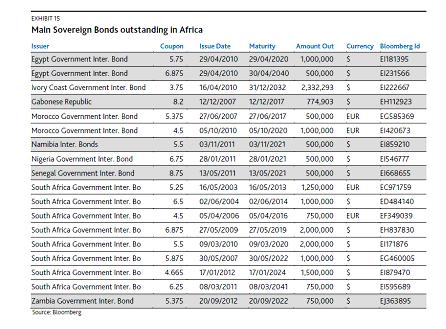

Bonds

The major outstanding sovereign bonds on the continent are shown in the table below.

Source: Moody’s

Companies

The Resource Curse: Lack of infrastructure remains challenging for industrial development

Tom Albanese, former Chief Executive of Rio Tinto, left the firm in January following a writedown of around £9bn in related to core units in Mozambican coal and the Alcan aluminium group. The writedown mainly concerned $7bn related to the Alcan unit which Rio Tinto acquired at the top of the market in 2007. But the Mozambican situation highlights a need for infrastructural investment and development to precede production to allow developing countries to benefit from these assets in a sustainable and meaningful way.

Nigerian Banking Sector continues to Rally, while South African banks expected to falter

Following a crisis in 2009, Nigeria’s banking sector continues to enjoy a robust recovery, and is widely expected by analysts to continue its rally. Recently this has been characterised by a significant increase in deposits. Proper financial market integration and broad provision of financial services would benefit Nigeria’s corporate community and the savings and loans needs of its rapidly expanding middle class. Nigeria’s banking sector has been overhauled by its central bank’s reforms, which have included the restructuring of loans and recapitalisation of troubled financial institutions. Meanwhile, Moody’s has changed the outlook for the South African banking system to “˜negative’ from “˜stable’ citing “weakening macroeconomic conditions” and downside risks related to the broader global environment.

South African Retailers thrive driven by discretionary spend

Increases in discretionary spend have been a boon for South African retailers. Woolworths reported a massive increase in Sales of 18% for the first of half of its financial year, which echoed the recent trend in increased revenues for other stocks in the sector, such as Truworths and Mr Price.

South African mining sector troubled by continuing labour unrest and management change

South Africa was almost brought to its knees on 16 August 2012 when 34 miners were killed during a wildcat strike at Lonmin PLC’s Platinum Mine in Marikana. South Africans were angry and shocked at the shootings, and the labour unrest spooked investors. Recovery in the mining sector has been tenuous since then and ripples of the unrest continue to cause problems at mines. Amplats was forced to halt production last Tuesday across its entire South African operations following the eruption of wildcat strikes. This plunges the company into further troubles following its announcement of major losses on 4 February. AngloGold Ashanti reported a Q4 63% decline in headline earnings per share this week, while BHP Billiton reported a half year 58% fall in profits. The sector overall has also seen several radical management changes over the past year.

News and Events

- Past

February 5 2013: The Economist Africa Summit: Africa Unchained: The Next Generation

The Economist Africa Summit was an essential briefing on the latest developments in finance and investment on the continent, particularly on the shift towards endogenous capital raising initiatives and alternatives on the continent. Financial market integration and development remains a hot topic. The rise of the African middle class was covered in an entire session. This is good news for drinks-retailer Diageo in particular, as Africans have developed a penchant for top-end single malts whiskies and other luxury beverages.

- Upcoming

11 March 2013: Royal African Society Business Breakfast

Donald Kaberuka, the president of the African Development Bank will be the speaker at the next RAS “˜Business Breakfast‘ on 11 March 2013 in London. The RAS’ Business Breakfasts are sponsored by Diageo and are a regular series of events for senior executives of companies, NGOs, policymakers and other experts. Invitations to the business breakfasts are available only to RAS corporate members at the discretion of the RAS.

21 March 2013: Royal African Society Business Breakfast

On 21 March 2013, Joyce Banda, president of Malawi, will be joining us for our second business breakfast of the year.

21 March 2013: Africa Redux

The University of Edinburgh Business School is hosting Africa Redux, an international conference on Political Economy, Development and International Finance with top academics and practitioners. Richard Dowden, director of the Royal African Society, Professor Chris Cramer of the School of African and Oriental Studies, Dr Daniel Large, of the Africa Asia Centre and the Rift Valley Institute, and the author will also be speaking.

26 to 27 March 2013: BRICS5

South Africa will host the fifth BRICS Summit from 26 to 27 March 2013 at the Durban International Convention Centre.

Desné Masie is the editor of the Business Africa Blog and manages the business programme for the Royal African Society