South Sudan: fighting could cripple oil industry for decades – By Luke Patey

The thousands of deaths reported in South Sudan’s current conflict may not be enough to motivate opposing sides to reach a ceasefire agreement at peace talks currently underway in Addis Ababa. But severe damage to the young country’s oil industry from a possible drawn-out civil war, and the loss of billions of dollars in future revenues, may get their attention. If the fighting continues, the opportunity for Sudan’s political elite to use oil as a tool for development, or for more unscrupulous practices of personal enrichment, may cease to exist.

First, it is important to note that oil was not the cause of the fighting in South Sudan. The now three-week long conflict grew out of a power struggle between President Salva Kiir and his former Vice-President Riak Machar, who now leads a loosely-knit rebellion of mutinied armed forces against the government. But oil regions quickly became strategic areas of control between government and rebel forces. And for whichever side winds up holding power at the conflict’s end, oil represents the prize.

When South Sudan became an independent country in July 2011, it took around 75% of Sudan’s oil resources with it. The 350,000 barrels per day (bpd) of oil production instantly became the lifeblood of the new nation’s economy. Petrodollars represent 60% of GDP and generate 98% of government revenues. If properly harnessed, oil has the potential to energize agriculture and other sectors of the economy, helping to lift the population out of widespread poverty.

But the oil wealth has been largely squandered. In 2012, President Kiir said that officials had stolen $4 billion in government funds, nearly one-third of all oil revenues earned from 2005 to 2011. Before the fighting broke out, Kiir was considering signing the Petroleum Revenue Management Act into law to tackle corruption, but today the entire industry is in jeopardy.

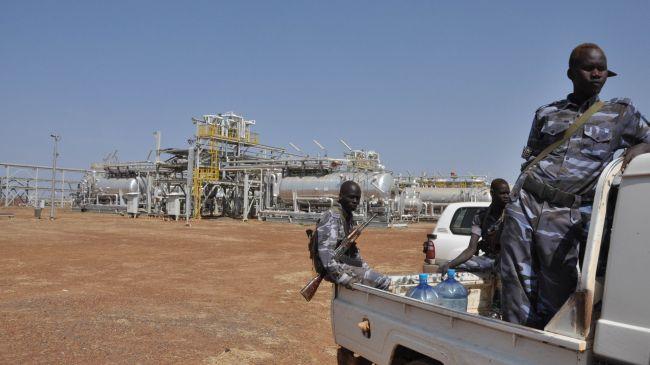

It only took a few days for both South Sudan’s oil-producing states, Upper Nile and Unity, to become caught up in the conflict. Upper Nile state was churning out 200,000 bpd, 80% of South Sudan’s total oil production, when the fighting started in December. Battles quickly tore through the state capital of Malakal along the White Nile. Rebels also targeted Upper Nile’s oilfields, located some 200 kilometers northeast of the capital. The Adar Yale oilfield has come under attack on multiple occasions and the China National Petroleum Corporation (CNPC), the biggest player in South Sudan’s oil industry, evacuated hundreds of personnel from the Palogue oilfield, South Sudan’s largest oilfield, and arguably the crown jewel of its economy.

South Sudan’s oil ministry is adamant that production from Upper Nile has not been affected by the conflict. But traders of its heavy sweet, acidic Dar crude blend have been instructed that January cargoes will be delayed, indicating that production has dropped by 50,000 bpd to date. Without Chinese and other foreign staff, a limited number of South Sudanese technicians will struggle to keep production levels high. Sudan, which planned on generating 10% of its 2014 budget from oil fees and transfers from South Sudan, has offered to send its own personnel.

In Unity state, the oil industry has completely shut down. The Greater Pioneer Operating Company (GPOC), made-up of the China National Petroleum Corporation, Petronas of Malaysia, and India’s ONGC Videsh, hastily halted production, about one-fifth of South Sudan’s total, and evacuated staff when fighting erupted at the Unity and Thar Jath oilfields. Major General James Koang, commander of the fourth division of South Sudan’s army, then defected to the rebel side and took control of the oil town of Bentiu.

If the fighting intensifies in Unity and Upper Nile in the coming months, it will have two devastating consequences for South Sudan’s oil industry. The first will be for the 1,300 kilometer oil pipeline stretching from Upper Nile across the border to Sudan’s Red Sea coast. In January 2012, a dispute with neighbouring Sudan over pipeline fees led South Sudan to close its oil production for 15 months. Chemically treated water was used to flood and fill the Upper Nile pipeline in the interim, but the solution and residual oil only increased the normal rate of corrosion to the pipeline’s interior. If the conflict leads to another closure of Upper Nile oilfields, a second shutdown will do significant damage to the billion-dollar pipeline, or even render it obsolete.

The second consequence will be for South Sudan’s future oil production. Output levels at Unity state oilfields were already in steep decline before the conflict. From a peak of nearly 288,000 bpd on average in 2004, they fell to below 125,00 bpd by June 2011, one month before South Sudan’s independence from Sudan. A Norwegian study found that the oil recovery rates could be pushed up, and generate billions in new revenue, but the investment in technology was estimated to cost up to $300 million for a single field. Oil companies will be reluctant to sink sizable new capital investments in such a politically instable environment where security risks have grown. As a result, the current conflict is likely to precipitate the decline of South Sudan’s oil production, forecast in 2013 to fall below 100,000 bpd in the next decade.

Rebels may think that by capturing oilfields they can attain a lucrative bargaining chip in negotiations with the government. The more oil areas they control, the weaker President Kiir becomes without his main source of income. At the same time, the South Sudan government is currently launching a major offensive to take back oilfields in Unity state. But the goal of the South Sudan government and rebels to control oil areas may backfire and escalate the conflict even further as the two sides exchange blows near their most coveted resource.

If the fighting does not stop soon then the two sides will be responsible for crippling South Sudan’s oil industry for years, if not decades to come. On top of the death and destruction, they will be remembered for burying their country’s economic future. The prize is big enough to share, but only if they stop fighting.

Luke Patey is a senior researcher at the Danish Institute for International Studies. His book “˜The New Kings of Crude: China, India, and the Global Struggle for Oil in Sudan & South Sudan‘ will be launched at the RAS on 21st January.

[…] le Soudan du Sud se retrouve en possession de 75% des ressources pétrolières du Soudan rappelle African Arguments. Mais Juba est contraint de négocier l’acheminement de cette manne vers les bords de la mer […]