Managing Risks in the Extractive Industries – By Lionel Badal

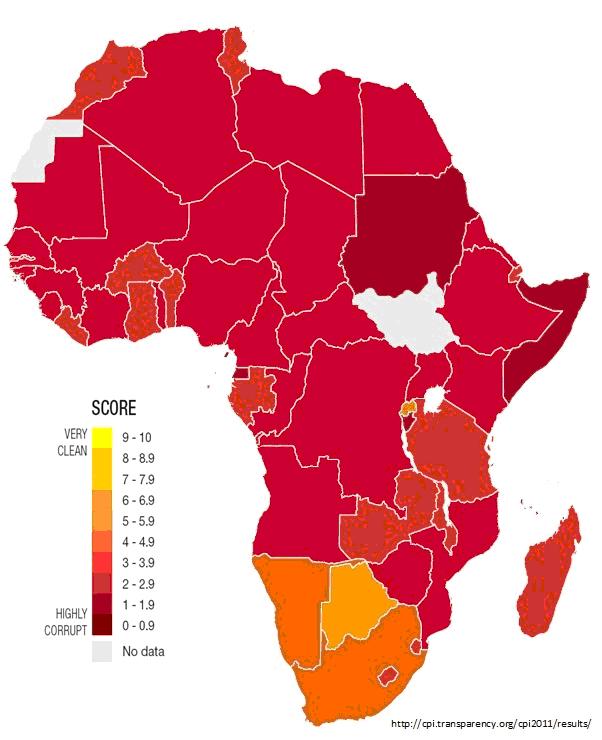

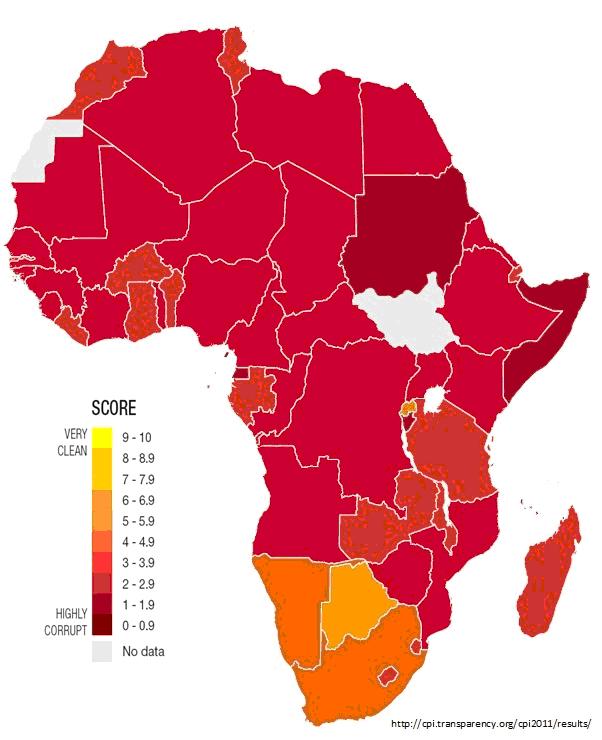

Transparency International’s Corruption Perception Index shows African countries remain problematic locations for business operations.

Rising demand fuelled by emerging countries, most notoriously China and India, has led to increased competition for natural resources. Despite recurrent volatility in the markets, the trend is a rise in prices, oil being the prime example. In this context, frontiers have disappeared and previously overlooked regions, which include Western and Central Africa, constitute the new El Dorados.

With higher prices, massive investments needed to extract oil, gas and minerals in often unstable and poorly accessible regions, become a profitable endeavour. In short, the risk–benefit equation has changed.

This will not be news for anyone who has been working in the region. Yet, specific risks associated with those opportunities remain too often overlooked by investors. Indeed, according to Ernst & Young, fraud and corruption ranked only tenth in its risk survey for the mineral and metals industries. For the oil & gas industry, the result was even worse: fraud and corruption did not even appear on the radar.

Mind-sets need to change

As a reminder, 23 African countries remain in the bottom 30 of the World Bank’s 2011 Ease of Doing Business Index. They include key extractive industry protagonists such as Angola, Congo-Brazzaville, the Democratic Republic of Congo, Equatorial Guinea, Gabon and Niger. Though a little better, Nigeria still achieves a poor 133rd place. Corruption, meanwhile, remains pervasive – well demonstrated by Transparency International’s “˜Corruption Perception Index.’ . Needless to say, this is not exclusive to Africa and Botswana is here to remind us that the so-called “resource curse” is not always fatal for the development of good governance.

In these high-risk zones and highly competitive sectors, investors can be tempted to disregard good practises in order to secure deals, reduce delays and improve their overall margins.

Examples of criminal actions can include illicit payments, for example bribery of a civil servant in order to expedite administrative processes, indirectly financing criminal entities, human rights violations such as forced labour or the violent relocation of local populations, and the violation of international sanctions – this has been particularly relevant for the diamond industry since the establishment of the Kimberley Process in 2000.

Investors can also be tempted to ignore illegal acts committed by their local joint-venture partners, often linked to, if not controlled by, politically exposed persons. But ignorance is no legal protection. Such short-term tactics are dangerous and counter-productive.

Unscrupulous investors do not only face expensive legal sanctions, with possible jail terms, but also unmanageable PR disasters. A company’s reputation is a precious asset, which in the era of Twitter can be devastated in no time. Rebuilding a positive (or at least neutral) image is a costly and time-consuming process. Make no mistake, anticorruption NGOs such as Global Witness and Transparency International have acquired advanced investigative skills, and few would like to be their next targets.

We are facing a paradigm-shift

Companies tend to be familiar with the 1977 US Foreign Corrupt Practices Act (FCPA) and the more recent UK Bribery Act (2011), which provide strong extra-territorial legal incentives to prevent corruption. Meanwhile, the Extractive Industries Transparency Initiative (EITI) aims to reduce corruption by making public the amounts of money transferred between extractive industry companies and governments. Though the EITI is an important contribution, it still suffers from a fundamental weakness: it remains a voluntary scheme, which countries can choose to ignore.

Following tough negotiations, on the 22nd of August of this year, the US Securities and Exchange Commission (SEC) adopted Sections 1502 and 1504 of the 2010 Dodd-Frank Act on financial reform. They set new standards for the extractive industries.

Section 1502 requires companies listed in the US to strengthen their supply-chain due diligence in order to prove that the minerals they purchase do not fund armed groups. Companies now have two to four years, depending on their size, to put in place rigorous processes. In effect, they will have to investigate the origin of the minerals they buy, the actors involved and any potential liability. This has the potential to change the manner business is done in conflict-prone countries such as the DRC and in doing so, to cut funding for violent groups existing within the “˜conflict economy’.

Regarding Section 1504, it will reinforce and complement the EITI by requiring companies in the oil, gas and mining sectors to disclose payments made, on a project-by-project basis, to foreign governments. Since every company listed in the US will have to respect the rule, countries will not be able to escape it. Any discrepancy in the figures will then be easily identified, making it harder for corruption to go unpunished. The European Union will soon pass a similar law, which will include timber companies. Investors can either conform or face severe sanctions.

Anticipation and the systematic reduction of risks

In light of these factors, should companies stop investing in high-risks regions? The answer is no, but they need to adopt effective risk-management policies.

First, they need to assess and monitor potential risks present in their sectors and geographical areas. Importantly, political, economic and social contexts vary greatly from country to country. Within countries themselves, we find great nuances, something particularly true for regional heavyweights such as Nigeria and the DRC. Ignoring them can cause costly mistakes.

Second, they need to become familiar with new legal frameworks as they directly affect their operations and strategy. In quickly changing environments, investors need to be proactive.

Furthermore, companies need to make decisions based upon reliable first-hand information. In other words, companies need to collect, through legal and ethical means, information about the products they buy and the partners they work with. In high-risk regions, companies need to conduct comprehensive due diligences and supply-chain mapping; this is crucial in assessing the integrity and reputation of anyone or anything that touches the company.

Lastly, companies need to strengthen and identify potential loopholes in their internal procedures and structures related to anticorruption.

While risks are an inevitable part of business development, a successful investor will aim to mitigate them, whenever and wherever possible.

Lionel Badal works as an Analyst for ARIS-Intelligence, a business intelligence company based in Abidjan and Lagos.